wa sales tax finder

Use this search tool to look up sales tax rates for any location in Washington. Below is an example of how to report local retail sales tax on your excise tax return assuming sales of motor vehicles total 50000 and repairs total 10000 in Grays Harbor County.

Groceries and prescription drugs are exempt from the Washington sales tax.

. Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue. Search for unclaimed property. Tax rate lookup mobile app.

Vehicles received as gifts. Retail sales tax includes both state and local components. Lodging information and rates.

With local taxes the total sales tax. Lookup other tax rates. Free calculator to find the sales tax amountrate before tax price and after-tax price.

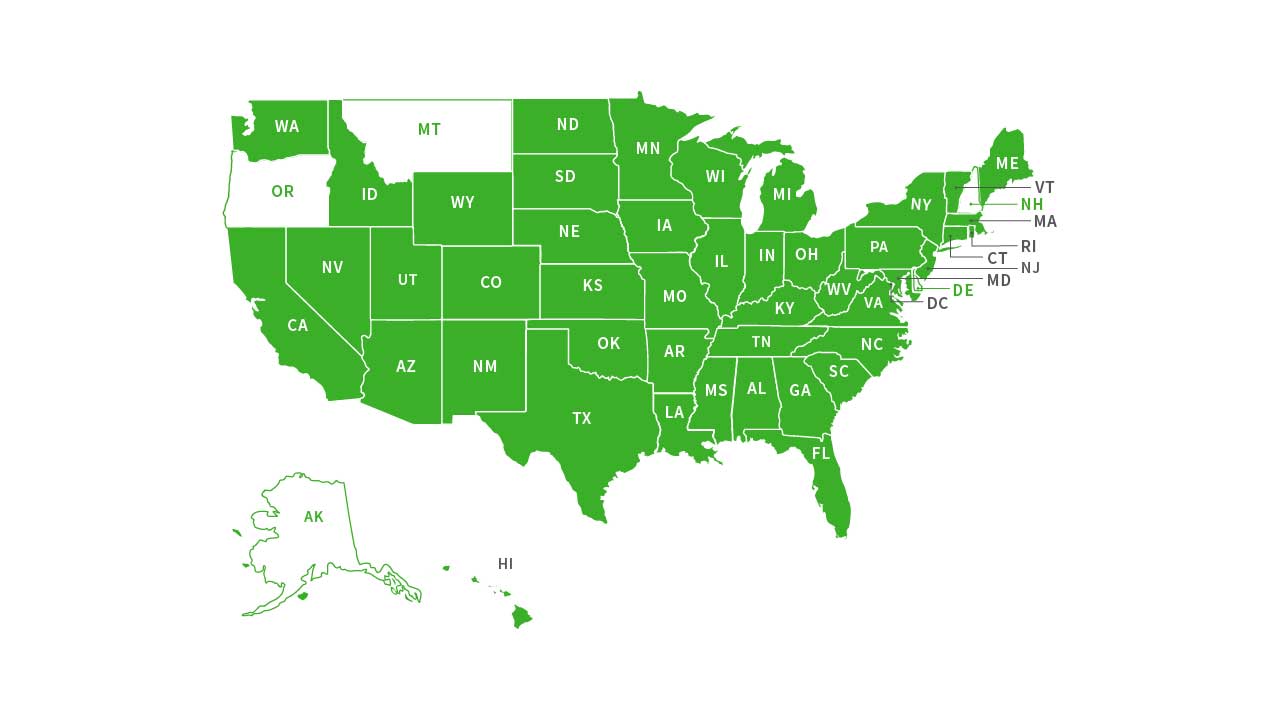

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the. Find Sales tax rates for any location within the state of Washington. Forty-five states and Washington DC.

Whether business or customer anyone can verify the correct tax rate where they are standing with one tap in the app. Use tax is paid by the consumer when retail sales tax was not collected by the seller. Address and get the sales tax rate for the exact location with the Avalara real-time sales tax calculator.

WA Sale Tax Lookup is architected as a standalone application or microservice so that youre not dependent on the State of Washingtons IT infrastructure. Download WA Sales Tax Rate Lookup for Android to wA State Sales Tax Rate LookupWashington State Department of Revenue Use this app to find the sales and use tax rate and code for any location in. The seller is liable to the Department of Revenue for sales tax even if it is not collected.

31 rows The state sales tax rate in Washington is 6500. The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. This is the total of state county and city sales tax rates.

To calculate sales and use tax only. It has gained around 10000 installs so far with an average rating of 40 out of 5 in the play store. The app allows users to save tax.

Here is some helpful information. --ZIP code is required but the 4. Counties and cities can charge an additional local sales tax of up to 31 for a maximum possible combined sales tax of 96.

Once this app has cached the sale tax data from the states website which happens on start up youre good to go until the next quarter. All have a sales tax. The Washington sales tax rate is currently.

File a consumer use tax return. If you can provide proof that the person who gave you the vehicle or vessel paid sales or use tax on the vehicle or vessel no use tax is due. What is the sales tax rate in Bellevue Washington.

The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Washington has 726 special sales tax jurisdictions with local sales taxes in. Information and rates for car dealers leasing companies.

2022 Washington Sales Tax Table. If the person who gave you the gift owned the vehicle for 7 years or more and is from a state or province with sales tax it will be assumed that tax was paid and no proof is. The minimum combined 2022 sales tax rate for Bellevue Washington is.

Tax guide South Carolina sales tax guide Tennessee sales tax guide Texas sales tax guide Utah sales tax guide Virginia sales tax guide Washington sales tax guide Wisconsin sales. Decimal degrees between 450 and 49005 Longitude. List of sales and use tax rates.

There is no national or federal sales tax. Also check the sales tax rates in different states of the US. OIT Service Desk 614-644-6860 or 877-644-6860 or -- email.

Tax rate change notices. This means that depending on your location within Washington the total tax you pay can be significantly higher than the 65 state sales tax. Streamlined Sales Tax Web Service.

WA Sales Tax Rate Lookup is an Android Business app developed by WA State DOR and published on the Google play store. Express file a no business return. Find the TCA tax code area for a specified location.

Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on top of the state tax. WA Sales Tax Rate Lookup requires Android with an OS version of 21 and up. Sales tax rates can be made up of a variety of factors.

The three-tenths of one percent 003 Motor Vehicle SalesLease Tax that was implemented. Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device. Access a reseller permit.

If you have questions or concerns about information listed on The Finder please contact. Washington has 726 special sales tax jurisdictions with local sales taxes in. Sales tax is governed at the state level meaning each state sets their own laws and rules when it comes to sales tax.

Taxes are much more important in the south and west than they are in New England and the industrial Midwest. Florida Washington Tennessee and Texas all generate more than 50. Find out what each state has to say about sales tax here.

Washington state businesses working in multiple locations can now find sales tax rates quickly and easily using their current location or by entering an address. Whether youre in the office out on the job site or having an item delivered you can check this app to verify the. The WA Sales Tax Rate Lookup app provides the current local sales tax rates and calculates the amount of sales tax to charge.

Washington Geospatial Open Data Portal. WA Sales Tax Location Codes Boundaries. Skip to main content.

Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device. Build your own location code system by downloading the self-extracting files to integrate into your own accounting system. The Finder is a service offered by the Office of Information Technology OITDepartment of Administrative Services.

Request a tax status letter. Determine the location of my sale. Decimal degrees between -1250 and -1160.

Woocommerce Sales Tax In The Us How To Automate Calculations

States With Highest And Lowest Sales Tax Rates

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Washington Sales Tax Guide And Calculator 2022 Taxjar

Washington Sales Tax Small Business Guide Truic

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Sales Tax Calculator For 98359 Olalla Washington United States In 2016 Sales Tax Heber Heber City

Washington Income Tax Calculator Smartasset

Washington Income Tax Calculator Smartasset

How To Charge Your Customers The Correct Sales Tax Rates

Washington Sales Tax Information Sales Tax Rates And Deadlines

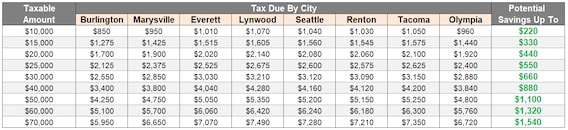

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Calculator For 98335 Gig Harbor Washington United States In 2017 Gig Harbor Gigs Harbor

Washington Sales Tax Handbook 2022

The Consumer S Guide To Sales Tax Taxjar Developers