child tax credit 2022 qualifications

WASHINGTON The Internal Revenue Service has started sending letters to more than 36 million American families who based on tax returns filed with the agency may be eligible to receive. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27.

Child Tax Credit Applications Eligibility Amount And Deadline Marca

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit.

. Most people with children qualify automatically. Parents with higher incomes also have two phase-out schemes to worry about for 2021. You are eligible for a property tax deduction or a property tax credit only if.

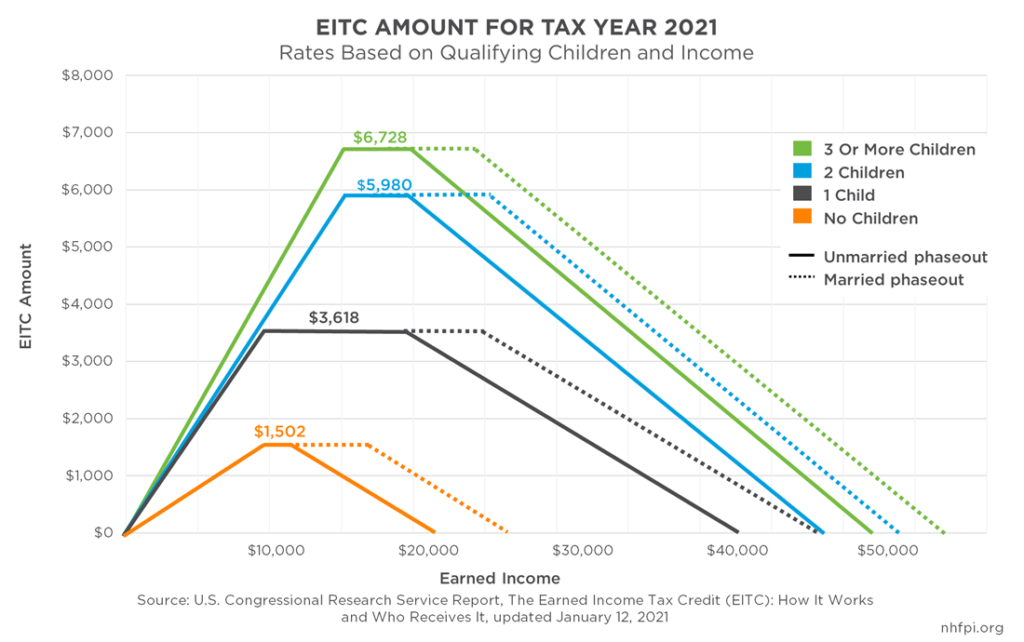

New Yorks Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a.

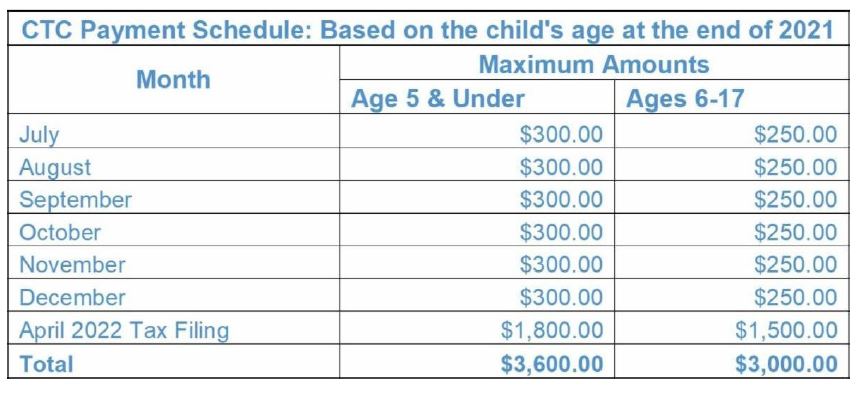

In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17. Congress also temporarily expanded the Child Tax Credit CTC to include more families and increased the payment amounts. The first one applies to.

2 days agoThe expanded child tax credit for 2021 can be worth as much as 3600 for each qualifying child age 5 and younger. The Child Tax Credit is a tax credit worth up to 2000 per qualifying child. If the amount of the credit exceeded the tax that was owed the taxpayer.

The US Census Bureau shared data that shows the impact the Child Tax Credit had on families across the country. The deadline for this money is also fast approaching people who qualify have to file their information by. Information about qualifications of children income and age.

Find out if you are eligible for the child tax credit or why you might not qualify. The credit is refundable which means that if it exceeds the amount of taxes you. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of.

A residential energy tax credit is a tax credit that helps offset the cost of energy-efficient improvements to homes. Be your own child adopted child. Tax Changes and Key Amounts for the 2022 Tax Year.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. From 2018 till 2020 an offset was worth 2000 per child for children aged up to 16 years or younger under the child credit tax. Have been a US.

Changes Made to Child Tax Credit in 2021. Child Tax Credit. Starting with Tax Year 2022 eligible New Jersey residents can claim a refundable Child Tax Credit on their New Jersey Resident Income Tax Return Form NJ.

The credit is available for a variety of home improvements. Census data shows impact of federal Child Tax Credit. The 20222023 New York State budget allows for one-time checks to eligible taxpayers for both the Empire State child credit and the one based.

If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you might qualify for up to 1000 through the Young Child Tax. Are being sent to people who appear to qualify for the Child Tax Credit CTC Recovery Rebate Credit RRC or Earned Income Tax. The credit is worth up to 3000 for each qualifying child.

The child tax credit CTC will return to at 2000 per child in 2022.

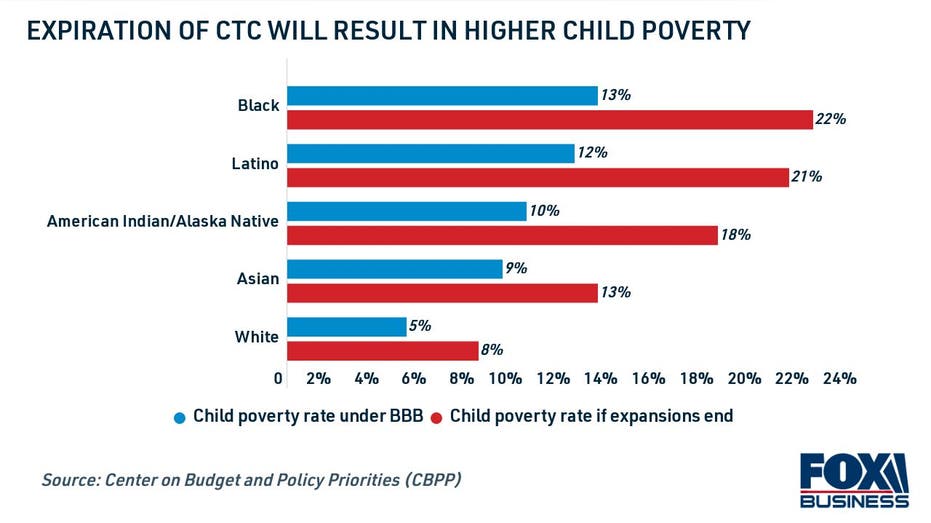

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2022 Everything You Need To Know Walletgenius

Forcing People To Work So They Can Get A Child Tax Credit Is A Terrible Idea In These Times

About The 2021 Expanded Child Tax Credit Payment Program

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2022 Who Is Eligible For Child Payments Oct Finance

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

What Is The Child Tax Credit Tax Policy Center

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Newswire

Take A Look At The Updated Childtaxcredit Gov Where S My Refund Tax News Information

Child Tax Credit 2022 Who Is Eligible For Child Payments Oct Finance

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

Irs Wants Millions To Claim Child Tax Credit Stimulus Funds Wjtv

2021 Child Tax Credit Advanced Payment Option Tas

Child Earned Income Tax Credits 02 16 2022 News Auburn Housing Authority Auburn Alabama